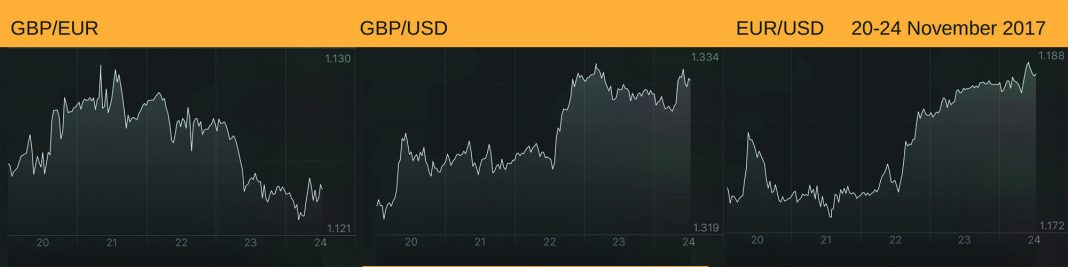

This week the UK budget was delivered without a hitch or any embarrassing U turns. The cut in Stamp Duty will stole the headlines but the real story be the significant cuts to the UK’s growth forecasts. The pound reacted by climbing a cent against the US dollar but stayed steady against the euro.

Meanwhile there has been a bit of Brexit chatter this week with Theresa May suggesting she could double the ‘divorce payment’ to £40 Billion. Meanwhile the EU have been muttering about how ‘chaotic’ the UK’s negotiating team is and that they ‘lack a clear strategy’. One Czech minister suggested Boris Johnson was ’unimpressive’ so it was a bad week for British pride not helped by the gloomy economic forecasts. It’s not all plain sailing in Germany either where they are still without a government and could face fresh elections to sort it out.

The euro’s gain against the pound was thanks to an upbeat outlook from the European Central Bank (ECB); data continued to point towards the Eurozone recording its best growth rate in a decade. Euro summary: despite Italian banking issues, the Catalan Independence situation and German politics stuck in the mud, there is confidence in the economic outlook.

So what does all this mean to someone buying currency? The real message is that there will be both positive and negative factors affecting a currency as shown by the euro this week. How the market decides which factors are strongest is not possible to decipher so be very careful when deciding your target price and always have a ‘worst case’ price or safety net.

Written by www.thecurrencyexchange.co.uk