HMRC delivered two talks in the Alicante province this week. During their talks they reminded British Nationals, who live in Spain but have assets in the UK, or who are UK tax residents, that they should make sure they have declared all their overseas taxable income to HMRC. Those who don’t could face tougher penalties in the future.

The two events, held in Rojales and Teulada/Moraira, were well attended by UK citizens keen to know the latest legislation which may affect them. Attendees also had the opportunity to ask questions.

The representatives from HMRC gave an overview of what kind of assets may need to be declared, such as income from renting a property out in the UK or UK government pensions received abroad, and explained how to start the declaration process.

During the question and answer session at the end, HMRC also took the time to listen to UK nationals’ concerns around filling in tax returns whilst overseas and clarifying points around the Spain/UK double taxation agreement, which they committed to feeding back in the UK.

British Consul, Sarah-Jane Morris, who attended both events said: “I’m really pleased that HMRC has come to this area, where so many British Nationals live.

The talks were very informative and I hope those who attended will help spread the word that it is important to ensure your tax affairs are in order. More information can be found on the gov.uk website which I urge British nationals resident in Spain to check”.

As part of the British Government’s “Requirement to Correct” legislation, UK taxpayers must make sure that all their foreign income and assets, where they might be tax to pay, have been declared to HMRC before 30 September 2018.

From 1 October 2018, new, substantially higher penalties will apply for those who have failed to pay all the tax due on foreign income and assets. The vast majority of people pay and businesses pay the right amount of tax. The new legislation is aimed at those who fail to pay tax on their offshore income or assets.

If you are concerned that you haven’t told HMRC about foreign income or assets, or that you have transferred income abroad without paying UK tax on it, you should notify HMRC before 30 September 2018. You could also consider taking independent professional advice before deciding what to do next.

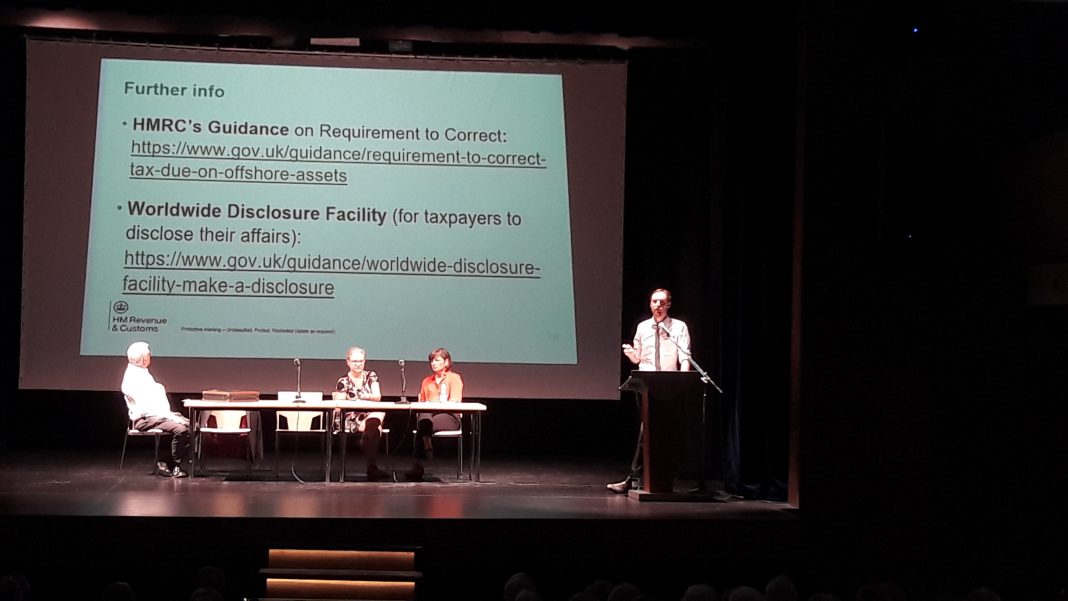

Anyone who would like more information on the new “requirement to correct” UK law, can look online on the gov uk at: https://www.gov.uk/guidance/requirement-to-correct-tax-due-on-offshore-assets

To start the process of declaring overseas assets please visit: https://www.gov.uk/guidance/worldwide-disclosure-facility-make-a-disclosure