I know that many British expats living in Europe are feeling very anxious about the pound-euro exchange rate at the present time. Although not unexpected, Brexit has started a period of considerable financial uncertainty for expats, which will take some time to resolve.

Many expats rely upon an income from the UK, be it a salary or a company or state pension, and even a small difference in the exchange rate will make a considerable difference to their standard of living. Gone are those heady days when one pound would buy 1.50 euro; even at that time many of us realised that the pound was grossly overvalued, and that a day of reckoning would happen in the future. Even so, it was nice whilst it lasted.

At the time of writing, commenting about currency exchange rates is always difficult, since this article may be read many weeks or months after it is written, and the pound appears to be heading for parity with the euro. Some financial ‘experts’ are already claiming that the pound will shortly be worth less than the euro, whilst others are claiming that the pound will revert to its usual ‘high’ after a year or two, or when Brexit is finally settled.

Frankly, it is all guess work and we may as well ask, “How long is a piece of string?” In reality, no one knows, so let us deal with issues that expats and holidaymakers are facing here and now, and let us make the most of the pounds that we have.

Holidaymakers and expats are already complaining that they are receiving only one euro for one pound at airport currency exchange desks. My view is that if they are foolish enough to exchange their pounds at the airport just before they leave for their holiday, they deserve a poor exchange rate.

Airport currency exchange rates have to include charges for their fancy booths and shops, trained staff and smart uniforms; one is paying for convenience and this is the penalty for leaving it so late. The more astute travellers arrange their overseas currency long before they leave the UK, maybe through an online currency exchange dealer, their local bank or the Post Office. I suggest that travellers use none of these services, and that many more competitive services are now available that will leave more currency in their pockets.

Today, at the time of writing and after speaking to some holidaymakers who were complaining to me that they received less than parity at a currency booth in Gatwick Airport, I managed to get 1.12 euros for one pound by using an app on my mobile phone when I went shopping today, as well as drawing cash out of a local ATM.

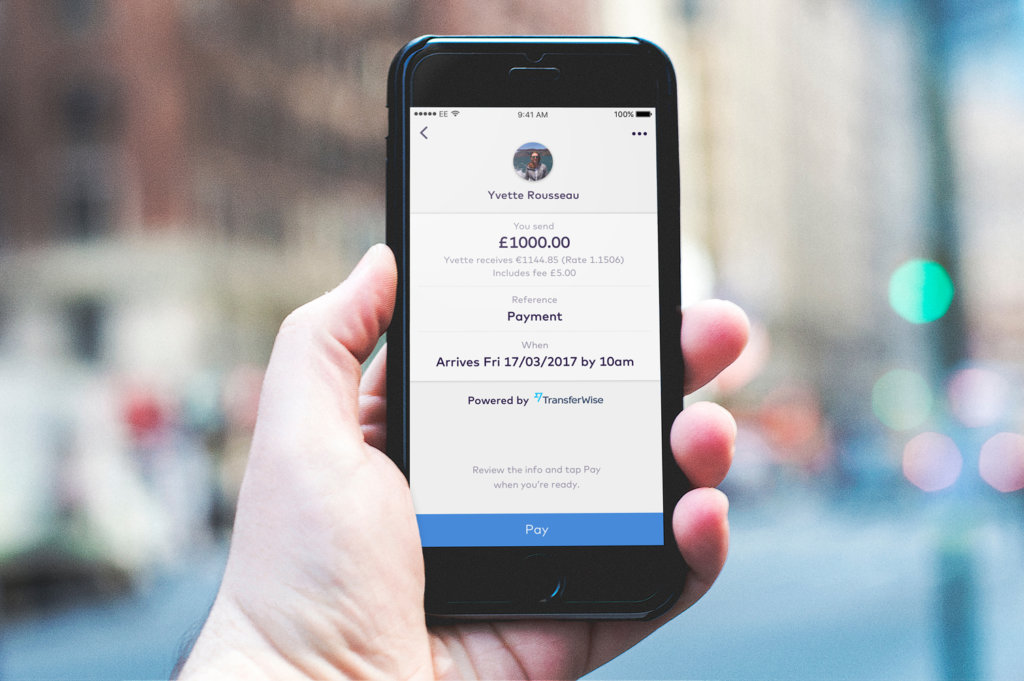

For transactions in Europe, I usually use a debit card provided by a ‘fintech’ company called Revolut for many of my currency transactions, or a debit card provided through a superb UK banking operation called Starling Bank. There are several others to consider, such as Monzo and Monese that offer similar services that should be considered.

All of these companies provide a mobile phone app and a prepaid debit card that you can use to pay for goods and services whilst on holiday or to draw cash out of overseas ATMs. Instead of paying a fancy commission to one of the airport currency exchange booths, holidaymakers and expats can obtain currency at wholesale rates through the use of these services.

If living in Europe, I recommend that British expats seriously consider opening an account with Revolut or Monese. If maintaining an address in the UK, go for Starling Bank or Monzo for the best currency exchange rates. Another app based bank, N62, which I also use, is based in Germany and offers full banking protection.

Although currently only offering a euro-based account, it is planning to offer a sterling account, as well as a euro account in the near future, and is certainly well worth keeping an eye on. All of these accounts can be opened through your iPhone or Android device.

They have certainly made my financial life overseas easier to manage, and I am no longer ripped off by the large currency exchange services. For further information about these services, please go to the Expat Survival website: http://expat.barriemahoney.com

If you enjoyed this article, take a look at Barrie’s websites: http://barriemahoney.com and http://thecanaryislander.com or read his latest book, ‘Footprints in the Sand’ (ISBN: 9780995602717). Available in paperback, as well as Kindle editions.

© Barrie Mahoney